Recent trends in hospital market concentration and profitability: the case of New Jersey

Highlight box

Key findings

• Hospital markets in New Jersey underwent increasing rates of consolidation from 2010 to 2020.

• By 2020, six hospital market areas that accounted for 71% of total admissions in the state were considered “highly concentrated” by the United States federal standards.

• Hospital market concentration was positively associated with operating margin at higher levels of concentration.

What is known and what is new?

• Multiple studies have examined associations between market concentration, profitability, price, and price growth.

• This study adds to the literature by undertaking comprehensive analyses of the association between hospital market concentration and profitability utilizing data from New Jersey, a state dominated by not-for-profit hospitals.

What is the implication, and what should change now?

• Close monitoring by state and federal agencies of local hospital market consolidation with potentially negative effects, even among not-for-profit hospitals, is warranted.

Introduction

Background

Market consolidation has characterized the United States (U.S.) hospital industry since the 1980s, however, the pace of mergers and acquisitions (M&As), reflecting the rate of consolidation, sharply increased in the last decade following enactment of the Affordable Care Act (ACA). Nationwide, a total of 1,071 hospital M&As were announced from 2010 to 2022 (1,2), with many of them between close competitors in the same geographic area (3). Accordingly, as of 2017, around 80% of hospital markets in the U.S. were “highly concentrated” by U.S. Department of Justice (DOJ) and Federal Trade Commission (FTC) standards (4-6).

The positive association between consolidation and operating margins (i.e., profitability) has been well documented in the economics literature since the development of the structure-conduct paradigm in the 1960s–1970s (7). For instance, early research on M&As showed 4% to 7% cost reductions among target hospitals in the years post-mergers (8), which is sizable given 2016 aggregate U.S. hospital operating margins of 6.7% (9). Since then, even more studies have focused on the impact of hospital market consolidation on prices, finding a positive relationship that arises due to the increased bargaining power of merged hospital entities during negotiations with private insurers (10-12). Historically, researchers found price increases of over 20% when mergers occur in already concentrated markets (13), and more recent estimates while slightly lower and ranging between 10–20% support this relationship (14,15). In terms of ownership status, contrary to earlier observations (16), researchers have suggested that not-for-profit and government hospitals became increasingly willing to raise prices as they acquired more market power (17). In fact, Rabbani’s case study of a 2010 non-profit hospital merger in Ohio revealed the consequences of increased out-of-pocket payments by 123%, besides reduced utilization of care (18).

Whether the additional revenues after M&As are re-invested into patient care operations and whether such investments vary by ownership type has been another empirical focus. Recent literature examined the association of hospital private-public payer mix with hospital financial outcomes. Wang and Anderson (19), for instance, found that increased commercial insurance payment rates among not-for-profit hospitals were associated with increased financial surpluses and administrative expenses, yet smaller increases in patient-care related outlays.

Consistent with Wang and Anderson’s finding of disproportionate investment in non-patient-care expenses after M&A activities, other studies have found negative effects of consolidation on quality of care. While hospital systems often claim that consolidation leads to better quality for patients and lower costs for the combined systems, much of the evidence has demonstrated otherwise (11). Kessler and McClellan (20), in one of the earliest studies, found that higher market concentration led to a significantly higher rate of risk-adjusted 1-year mortality for nonrural elderly Medicare patients hospitalized for heart attack care. Schneider’s (21) cross-sectional estimates based on 373 California hospitals suggested higher risk-adjusted mortality rates in less competitive environments. More recently, Beaulieu et al. (3), using data on short-term acute care hospitals (ACHs) between 2007 to 2016, found hospital acquisition by health systems was associated with modestly lower ratings in patient experiences.

Rationale and knowledge gap

While the impact of market consolidation can be multipronged, in this study, we specifically examine its effect on profitability reflected in data on operating margins. We analyze changing market concentration and its association with operating margins for all hospitals in New Jersey over 11 years, from 2010 through 2020.

New Jersey offers a useful case study of the relationship between hospital consolidation and profitability and whether the evidence from prior studies is consistent in a state where hospital markets are predominantly not-for-profit. Hospitals in the state that are primarily not-for-profit have undergone substantial consolidation over our study period and data available from state regulators allowed us to examine in detail the impact of such M&A activities on profitability. Our work contributes to the somewhat limited number of comprehensive state-specific analyses published to date. Specifically, as over 80% of hospitals in New Jersey are not-for-profit, our study contributes to the literature on the extent to which the link between consolidation and profitability holds in markets dominated by not-for-profit hospitals. We believe our New Jersey-based analysis using data spanning 11 years beginning in the year of ACA enactment is an important addition to older and limited number of state-specific studies examining similar associations between market concentration and prices in California, Florida, and Massachusetts (22-26).

Objective

In addition to quantifying the effect on hospital profitability of hospital mergers in New Jersey during our study period (27), our findings are particularly relevant in the context of ongoing consolidation activities in the U.S. at large and, specifically, in New Jersey. In 2021, a proposed merger between New Jersey’s Hackensack Meridian Health and Englewood Health caught the attention of a multistate coalition of attorney generals who filed an amicus brief seeking to prevent the merger citing potential anticompetitive effects of lower quality and higher prices (28,29). The healthcare providers, that had received the initial approvals from State regulators, were already among the largest healthcare systems in the State. In 2022, the FTC effectively blocked the acquisition of Saint Peter’s Healthcare System by RWJBarnabas Health, a close competitor in central New Jersey (30). Yet, being the only independent hospital left in Middlesex County, Saint Peter’s Healthcare System recently turned to Atlantic Health System as its strategic partner in January 2024, intending to merge into a Morristown-based chain if granted regulatory approvals (31). Also, in April 2023, two southern New Jersey hospitals, Cooper University Health Care and Cape Regional Health System signed an agreement to merge, entailing more than 900 licensed beds and $2.2b in revenues (32). Our study will shed light on the implications of these planned mergers’ possible impact on profitability and higher pricing from diminished market competition.

Methods

Data sources

Our main data source was from New Jersey ACH Cost Reports1 for 2010 to 2020 provided by the New Jersey Department of Health (33), to which all state-licensed ACHs are required to report. In our study period, there were up to 73 ACHs in New Jersey each year. We utilized Cost Report data on: (I) maintained beds, which are beds that are set up and staffed (hereafter, beds), (II) total discharges and patient days, (III) operating income, and (IV) revenue. Our hospital data was supplemented with information from the Hospital Provider Cost Reports released by the Centers for Medicare & Medicaid Services (34), of which contains revenue breakdown by sources. For information on hospital characteristics we additionally utilized information from the New Jersey Hospital Association (NJHA) (35) and other public sources. Specifically, we searched for the consummation date of each M&A transaction to determine the timing of changes in hospital system ownership. Because of their potential financial vulnerability (36), we distinguished hospitals by their safety-net status, where safety-net hospitals (SNHs) were identified based on membership in the Hospital Alliance of New Jersey (HANJ) (37). Hospital urban status was defined using the 2020 rural-urban commuting area (RUCA) Code released by the U.S. Department of Agriculture (38). County-level unemployment rates were constructed with data from the Bureau of Labor Statistics (39) and matched to the hospital data based on zip code.

Primary measures

Geographic markets

We adopted the New Jersey hospital market areas (HMAs) defined by the New Jersey Commission on Rationalizing Health Care Resources (Commission) (40) by modifying the boundaries of the Dartmouth Atlas Hospital Referral Regions to conform to state lines.2 We allocated each hospital to an HMA based on the hospital zip code and information from the Commission (40).

Hospital financial outcomes

Our main outcome measure was the operating margin for each hospital, calculated as the ratio of operating income to total revenue, which reflects their profitability. Since prior research has linked hospital consolidation to prices, we also examined inpatient revenue per patient day and inpatient revenue per discharge to proxy measures of prices.

Market concentration

Our primary explanatory variable was the Herfindahl-Hirschman Index (HHI), a standard measure for market concentration adopted by the FTC and DOJ (41). The HHI is calculated by summing the squared market shares of all firms (comprising hospitals within the same system) in the geographic market (defined above). The index can take values ranging from near zero to one, where a value of one entails a monopoly in the market, and values close to zero denote highly competitive markets. By FTC and DOJ’s Horizontal Merger Guidelines (41), markets with an HHI of over 0.25 are considered to be highly concentrated; transactions that increase the HHI by over 0.02 in a highly concentrated market are seen as “likely to enhance market power” (42). For computing HHI, we calculated market share by beds in our analysis. However, as a sensitivity analysis, market share was also calculated based on total annual admissions and revenues; the resulting HHI measure was very similar. We also report the four-hospital concentration ratio (CR4) calculated as the combined market share of the four largest hospital systems in each area (43).

Analytic strategy

An ordinary least squares (OLS) regression was used to examine the relationship between operating margins (and inpatient revenue per unit) of individual hospitals and market concentration (HHI) in their respective markets. Our three main regression models are specified as:

where is , , or for hospital at time . All models are in quadratic form to account for potential non-linear relationships. Our baseline model [1] includes HMA fixed effects, denoted by , and year fixed effects, denoted by , are included to account for time-invariant differences between markets and non-linear trends across years. Model [2] additionally includes a vector of hospital-level control variables, . These include the number of beds, hospital ownership status, urban/non-urban status3, SNH status (time-invariant), and county-level unemployment rates. To adjust for possible impacts of unobserved hospital characteristics on our estimation, we specify model [3] with hospital fixed effects, , and year fixed effects.

We conducted additional sensitivity analyses. First, we excluded the year of 2020 from our estimation to examine whether our results are affected by the pandemic. That is, we estimated the same models with data from 2010–2019 only. Second, we conducted OLS specifications when HHI was lagged by one period to examine whether the effect of market concentration on margins occurs with a lag. Third, we stratified our main model by hospital bed size (i.e., above and below the median) to test for heterogeneity effects. Fourth, to aid the interpretation of our quadratic models, we estimated separate linear models for above and below the quadratic inflection points.

Results

Descriptive results

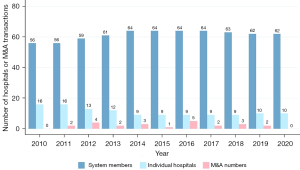

Our sample includes a total of 789 hospital-year observations. Between 2010 to 2020, the percentage of ACHs in New Jersey that were part of a hospital system increased from 77.8% (56 system members) to 86.1% (62 system members) (see Table 1 and Figure 1). Table 1 includes trends in several measures reflecting different aspects of hospital consolidation over 2010–2020 for the state overall and each of the 8 HMAs in New Jersey. In New Jersey, with systems acquiring independent hospitals, the share of beds belonging to system member hospitals increased from 77.8% to 84.9%. M&As between individual systems decreased the number of systems operating in New Jersey from 29 to 21 and increased the average system size. Over 2010–2020, the average number of ACHs per hospital system increased from 1.9 to 3.0, and the average number of beds per system from 578 to 857. Consistent with these trends, the bed weighted mean CR4 in New Jersey increased from 81.0% in 2010 to 88.1% in 2020. Interested readers could also refer to Table S1 online, which enumerates M&A events in New Jersey during our study period.

Table 1

| Geographical area | 2010 | 2012 | 2014 | 2016 | 2018 | 2020 |

|---|---|---|---|---|---|---|

| New Jersey State | ||||||

| Hospitals, N | 72 | 72 | 73 | 73 | 72 | 72 |

| Systems, N | 29 | 29 | 29 | 24 | 23 | 21 |

| Hospitals in systems, % | 77.8 | 79.2 | 87.7 | 87.7 | 87.5 | 86.1 |

| Hospitals per system, mean | 1.9 | 2.0 | 2.2 | 2.7 | 2.7 | 3.0 |

| Beds in systems, % | 77.8 | 79.4 | 85.6 | 85.2 | 85.6 | 84.9 |

| Beds per system, mean | 578 | 596 | 623 | 736 | 769 | 857 |

| Admissions in systems, % | 82.0 | 82.5 | 88.6 | 89.6 | 89.7 | 90.0 |

| Admissions per system, mean | 33,133 | 32,887 | 32,482 | 38,513 | 38,290 | 39,991 |

| Bed-weighted CR4, % | 81.0 | 82.5 | 83.7 | 85.1 | 86.8 | 88.1 |

| Bed-weighted HHI | 0.25415 | 0.26310 | 0.27100 | 0.29317 | 0.30922 | 0.31173 |

| Operating margin, bed weighted mean, % | 1.9 | 2.5 | 3.2 | 5.0 | 3.4 | 0.8 |

| Atlantic City hospital market area | ||||||

| Beds in systems, % | 89.5 | 90.1 | 90.0 | 88.5 | 90.2 | 82.8 |

| Beds per system, mean | 306 | 301 | 297 | 254 | 305 | 351 |

| Bed-weighted CR4, % | 83.5 | 83.9 | 84.6 | 79.7 | 82.8 | 82.8 |

| Bed-weighted HHI | 0.22364 | 0.22788 | 0.22901 | 0.20099 | 0.22187 | 0.22081 |

| Operating margin, bed weighted mean, % | 1.8 | 0.2 | 3.8 | 5.3 | 2.3 | 1.6 |

| Camden hospital market area | ||||||

| Beds in systems, % | 97.0 | 100.0 | 97.1 | 97.2 | 97.2 | 97.2 |

| Beds per system, mean | 579 | 575 | 593 | 577 | 726 | 731 |

| Bed-weighted CR4, % | 88.4 | 90.3 | 87.9 | 88.4 | 97.2 | 97.2 |

| Bed-weighted HHI | 0.22152 | 0.25105 | 0.23416 | 0.22956 | 0.33353 | 0.34624 |

| Operating margin, bed weighted mean, % | 2.4 | 4.5 | 6.4 | 7.6 | 3.7 | 0.4 |

| Hackensack, Ridgewood and Paterson hospital market area | ||||||

| Beds in systems, % | 44.8 | 51.8 | 62.3 | 61.6 | 61.6 | 61.6 |

| Beds per system, mean | 531 | 478 | 411 | 471 | 470 | 472 |

| Bed-weighted CR4, % | 62.4 | 65.0 | 66.1 | 69.9 | 71.6 | 70.5 |

| Bed-weighted HHI | 0.12502 | 0.13080 | 0.13375 | 0.14755 | 0.15381 | 0.14988 |

| Operating margin, bed weighted mean, % | 1.5 | 3.8 | 4.1 | 4.0 | 5.0 | 4.2 |

| Morristown hospital market area | ||||||

| Beds in systems, % | 93.6 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Beds per system, mean | 631 | 507 | 498 | 659 | 636 | 606 |

| Bed-weighted CR4, % | 1 | 1 | 1 | 1 | 1 | 1 |

| Bed-weighted HHI | 0.48445 | 0.48044 | 0.50733 | 0.62769 | 0.62571 | 0.58053 |

| Operating margin, bed weighted mean, % | 1.4 | 0.1 | −4.7 | 7.2 | 13.0 | 12.6 |

| New Brunswick hospital market area | ||||||

| Beds in systems, % | 90.0 | 89.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Beds per system, mean | 377 | 366 | 429 | 435 | 476 | 540 |

| Bed-weighted CR4, % | 0.7 | 0.7 | 0.8 | 0.8 | 0.8 | 0.9 |

| Bed-weighted HHI | 0.16700 | 0.16674 | 0.21154 | 0.21632 | 0.20579 | 0.25168 |

| Operating margin, bed weighted mean, % | 0.7 | 0.8 | 1.3 | 2.6 | 2.0 | −2.7 |

| Newark/Jersey City hospital market area | ||||||

| Beds in systems, % | 61.6 | 71.3 | 72.0 | 72.4 | 73.0 | 73.2 |

| Beds per system, mean | 610 | 539 | 536 | 676 | 718 | 719 |

| Bed-weighted CR4, % | 74.7 | 78.5 | 80.1 | 84.9 | 85.4 | 85.0 |

| Bed-weighted HHI | 0.24325 | 0.25426 | 0.27494 | 0.32443 | 0.33579 | 0.33293 |

| Operating margin, bed weighted mean, % | 1.8 | 3.1 | 2.5 | 3.2 | −2.5 | −3.6 |

| Toms River hospital market area | ||||||

| Beds in systems, % | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Beds per system, mean | 910 | 893 | 868 | 884 | 905 | 907 |

| Bed-weighted CR4, % | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Bed-weighted HHI | 0.41614 | 0.41479 | 0.41362 | 0.41568 | 0.42475 | 0.42562 |

| Operating margin, bed weighted mean, % | 3.4 | 5.0 | 6.1 | 8.8 | 5.4 | −1.0 |

| Trenton hospital market area | ||||||

| Beds in systems, % | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Beds per system, mean | 291 | 303 | 296 | 247 | 228 | 242 |

| Bed-weighted CR4, % | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Bed-weighted HHI | 0.38583 | 0.40349 | 0.39654 | 0.40993 | 0.39720 | 0.41431 |

| Operating margin, bed weighted mean, % | 2.9 | −6.9 | −6.1 | −4.6 | −1.5 | −6.1 |

CR4, four-hospital concentration ratio; HHI, Herfindahl-Hirschman Index.

Examining the HMAs individually, we see that while the level of market concentration varied across geographic markets, many were already “highly concentrated” by federal standards in the middle of the study period. By 2020, six out of the eight HMAs had HHIs that exceeded the 0.25 threshold, which is considered as “highly concentrated” by the FTC and DOJ; four markets had their CR4 at 90% or greater. Morristown and Toms River had the highest HHI at 0.58 and 0.42, respectively. On average, while some increases in operating margins were observed in the earlier years, almost all HMAs exhibited relatively lower levels around 2020.

Table 2 presents the market characteristics used in our analysis. The total number of beds was rather stable over time, suggesting no substantial growth to the markets. Resulting from the M&A activities, some areas saw a decrease in non-profit ownership as hospitals acquired changed to proprietary status.

Table 2

| Geographical area | 2010 | 2012 | 2014 | 2016 | 2018 | 2020 |

|---|---|---|---|---|---|---|

| New Jersey State | ||||||

| Number of M&As | 0 | 4 | 3 | 5 | 3 | 0 |

| Beds, mean (SD) | 299.1 (177.8) | 292.0 (180.8) | 293.0 (181.2) | 291.7 (188.7) | 296.6 (191.5) | 298.5 (187.8) |

| Non-profit ownership, % | 87.5 | 86.1 | 84.7 | 78.9 | 80.6 | 80.3 |

| Governmental ownership, % | 4.2 | 4.2 | 2.8 | 2.8 | 1.4 | 1.4 |

| Proprietary ownership, % | 8.3 | 9.7 | 12.5 | 12.7 | 18.1 | 18.3 |

| Urban location, % | 93.1 | 93.1 | 94.4 | 94.4 | 94.4 | 94.4 |

| SNH status, % | 34.7 | 34.7 | 33.3 | 33.8 | 33.3 | 33.8 |

| County unemployment rate, mean (SD) | 0.10 (0.01) | 0.10 (0.02) | 0.07 (0.01) | 0.05 (0.01) | 0.04 (0.01) | 0.10 (0.02) |

| Atlantic City hospital market area | ||||||

| Beds, mean (SD) | 213.8 (99.3) | 208.6 (99.9) | 206.4 (103.4) | 179.5 (84.4) | 211.4 (95.6) | 211.9 (96.7) |

| Non-profit ownership, % | 87.5 | 87.5 | 87.5 | 87.5 | 87.5 | 87.5 |

| Governmental ownership, % | 0 | 0 | 0 | 0 | 0 | 0 |

| Proprietary ownership, % | 12.5 | 12.5 | 12.5 | 12.5 | 12.5 | 12.5 |

| Urban location, % | 75 | 75 | 75 | 75 | 75 | 75 |

| SNH status, % | 25 | 25 | 25 | 25 | 25 | 25 |

| County unemployment rate, mean (SD) | 0.12 (0.01) | 0.12 (0.02) | 0.09 (0.02) | 0.07 (0.02) | 0.06 (0.01) | 0.13 (0.04) |

| Camden hospital market area | ||||||

| Beds, mean (SD) | 248.6 (135.3) | 239.6 (153.1) | 254.5 (148.9) | 270.0 (156.7) | 271.8 (154.8) | 273.5 (153.5) |

| Non-profit ownership, % | 83.3 | 83.3 | 91.7 | 90.9 | 100 | 100 |

| Governmental ownership, % | 0 | 0 | 0 | 0 | 0 | 0 |

| Proprietary ownership, % | 16.7 | 16.7 | 8.3 | 9.1 | 0 | 0 |

| Urban location, % | 91.7 | 91.7 | 91.7 | 90.9 | 90.9 | 90.9 |

| SNH status, % | 16.7 | 16.7 | 16.7 | 18.2 | 18.2 | 18.2 |

| County unemployment rate, mean (SD) | 0.10 (0.01) | 0.10 (0.01) | 0.07 (0.01) | 0.05 (0.01) | 0.04 (0.01) | 0.09 (0.01) |

| Hackensack, Ridgewood and Paterson hospital market area | ||||||

| Beds, mean (SD) | 395.2 (264.6) | 384.6 (274.6) | 355.0 (281.5) | 352.8 (282.9) | 352.5 (283.1) | 353.4 (282.8) |

| Non-profit ownership, % | 83.3 | 83.3 | 61.5 | 61.5 | 61.5 | 61.5 |

| Governmental ownership, % | 8.3 | 8.3 | 7.7 | 7.7 | 0 | 0 |

| Proprietary ownership, % | 8.3 | 8.3 | 30.8 | 30.8 | 38.5 | 38.5 |

| Urban location, % | 100 | 100 | 100 | 100 | 100 | 100 |

| SNH status, % | 58.3 | 58.3 | 53.8 | 53.8 | 53.8 | 53.8 |

| County unemployment rate, mean (SD) | 0.09 (0.02) | 0.09 (0.02) | 0.06 (0.01) | 0.05 (0.01) | 0.04 (0.01) | 0.10 (0.01) |

| Morristown hospital market area | ||||||

| Beds, mean (SD) | 253.0 (225.7) | 253.6 (222.0) | 284.7 (231.1) | 282.4 (249.4) | 272.6 (255.8) | 259.7 (208.1) |

| Non-profit ownership, % | 100 | 100 | 100 | 71.4 | 71.4 | 71.4 |

| Governmental ownership, % | 0 | 0 | 0 | 0 | 0 | 0 |

| Proprietary ownership, % | 0 | 0 | 0 | 28.6 | 28.6 | 28.6 |

| Urban location, % | 75.0 | 75.0 | 85.7 | 85.7 | 85.7 | 85.7 |

| SNH status, % | 25.0 | 25.0 | 14.3 | 14.3 | 14.3 | 14.3 |

| County unemployment rate, mean (SD) | 0.09 (0.01) | 0.08 (0.01) | 0.06 (0.01) | 0.04 (0.00) | 0.03 (0.00) | 0.08 (0.01) |

| New Brunswick hospital market area | ||||||

| Beds, mean (SD) | 313.6 (176.5) | 308.6 (176.0) | 321.6 (172.9) | 326.1 (171.9) | 317.1 (167.5) | 337.8 (175.1) |

| Non-profit ownership, % | 100 | 87.5 | 100 | 100 | 100 | 100 |

| Governmental ownership, % | 0 | 0 | 0 | 0 | 0 | 0 |

| Proprietary ownership, % | 0 | 12.5 | 0 | 0 | 0 | 0 |

| Urban location, % | 100 | 100 | 100 | 100 | 100 | 100 |

| SNH status, % | 25.0 | 25.0 | 25.0 | 25.0 | 22.2 | 25.0 |

| County unemployment rate, mean (SD) | 0.09 (0.01) | 0.08 (0.01) | 0.06 (0.00) | 0.04 (0.00) | 0.03 (0.00) | 0.08 (0.01) |

| Newark/Jersey City hospital market area | ||||||

| Beds, mean (SD) | 330.3 (139.7) | 314.9 (141.2) | 310.2 (151.7) | 311.4 (165.5) | 327.8 (182.5) | 327.5 (183.2) |

| Non-profit ownership, % | 66.7 | 66.7 | 66.7 | 50.0 | 50.0 | 50.0 |

| Governmental ownership, % | 16.7 | 16.7 | 8.3 | 8.3 | 8.3 | 8.3 |

| Proprietary ownership, % | 16.7 | 16.7 | 25.0 | 41.7 | 41.7 | 41.7 |

| Urban location, % | 100 | 100 | 100 | 100 | 100 | 100 |

| SNH status, % | 50.0 | 50.0 | 50.0 | 50.0 | 50.0 | 50.0 |

| County unemployment rate, mean (SD) | 0.10 (0.01) | 0.10 (0.01) | 0.07 (0.01) | 0.06 (0.01) | 0.05 (0.01) | 0.11 (0.01) |

| Toms River hospital market area | ||||||

| Beds, mean (SD) | 341.4 (141.2) | 335.0 (137.6) | 325.4 (122.9) | 331.4 (134.2) | 339.5 (146.4) | 340.0 (147.1) |

| Non-profit ownership, % | 100 | 100 | 100 | 100 | 100 | 100 |

| Governmental ownership, % | 0 | 0 | 0 | 0 | 0 | 0 |

| Proprietary ownership, % | 0 | 0 | 0 | 0 | 0 | 0 |

| Urban location, % | 100 | 100 | 100 | 100 | 100 | 100 |

| SNH status, % | 25.0 | 25.0 | 25.0 | 25.0 | 25.0 | 25.0 |

| County unemployment rate, mean (SD) | 0.09 (0.01) | 0.10 (0.01) | 0.07 (0.01) | 0.05 (0.00) | 0.04 (0.00) | 0.09 (0.00) |

| Trenton hospital market area | ||||||

| Beds, mean (SD) | 218.5 (37.7) | 227.5 (43.8) | 221.8 (40.3) | 185.5 (32.8) | 171.0 (24.5) | 181.2 (41.0) |

| Non-profit ownership, % | 100 | 100 | 100 | 100 | 100 | 100 |

| Governmental ownership, % | 0 | 0 | 0 | 0 | 0 | 0 |

| Proprietary ownership, % | 0 | 0 | 0 | 0 | 0 | 0 |

| Urban location, % | 100 | 100 | 100 | 100 | 100 | 100 |

| SNH status, % | 50.0 | 50.0 | 50.0 | 50.0 | 50.0 | 50.0 |

| County unemployment rate, mean (SD) | 0.09 (0.00) | 0.08 (0.00) | 0.06 (0.00) | 0.04 (0.00) | 0.04 (0.00) | 0.07 (0.00) |

Urban location is defined by RUCA code of a value of 1; SNH status is time-invariant. M&As, mergers and acquisitions; SNH, safety-net hospital; SD, standard deviation; RUCA, rural-urban commuting area.

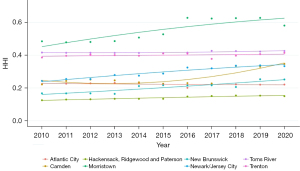

Figure 2 shows an upward trend in HHI over time across markets with the sharpest increases in the Morristown, Newark/Jersey City, and New Brunswick HMAs. Also, Morristown, Toms River, and Trenton, each of which experienced an upward trend, already had HHIs above 0.25 in 2010. Year-on-year HHI increases over the threshold of 0.02 (that is considered as likely to enhance market power) were documented nine times across four HMAs, namely in Camden, Morristown, New Brunswick, and Newark/Jersey City. The largest year-on-year growth in HHI was recorded in Morristown (an increase of 0.1 between 2015 and 2016), which also occurred along with the largest year-on-year increase in the weighted average operating margin (14.9 percentage points).

Regression results

Table 3 presents results from OLS regressions examining the impact of HMA-level HHI on individual hospital operating margins. As described, in addition to the main model [1], models [2,3] represent the robustness tests to the inclusion of measures of hospital and area characteristics. The coefficients for the linear and quadratic terms together indicate that, while initially an increase in HHI is associated with a decrease in the margin, this relationship eventually becomes positive. In specification [1], the relationship between HHI and operating margin becomes positive once a market’s HHI surpasses the inflection point of 0.361. In the appendix, we include results of two linear models confirming HHI’s negative correlation with operating margin below 0.361 and positive correlation above that level are both statistically significant (see Table S2). An F-test ruled out the null hypothesis that the coefficients on HHI and its squared term are jointly zero (F=11.63, P<0.001 for model [1]). Full results showing HMA and year fixed effects are presented in Table S3. The coefficients on the HHI terms are similar across models [1-3], suggesting our results are robust to the inclusion of additional controls and are not driven by unobserved hospital heterogeneity.

Table 3

| Variables | Model [1] | Model [2] | Model [3] |

|---|---|---|---|

| HHI | −1.5580*** (0.4191) | −1.6134*** (0.4072) | −1.2274*** (0.3601) |

| HHI2 | 2.1600*** (0.4647) | 2.2216*** (0.4533) | 1.5914*** (0.4017) |

| Number of beds | 0.0001** (0.00002) | ||

| Ownership status | |||

| Governmental | −0.0845*** (0.0269) | ||

| Proprietary | −0.0412*** (0.0131) | ||

| Urban location | 0.0710*** (0.0189) | ||

| SNH status | −0.0235** (0.0095) | ||

| Unemployment rate | −0.2035 (0.4295) | ||

| HMA fixed effects | Yes | Yes | No |

| Hospital fixed effects | No | No | Yes |

| Observations | 789 | 789 | 789 |

| R2 | 0.0792 | 0.1422 | 0.3917 |

**, P<0.05; ***, P<0.01. Year fixed effect included in all models. Model [2] imposes controls on hospital characteristics, including number of maintained beds, ownership status (for which the basis is non-profit ownership), a dummy variable for urban location (RUCA code of 1), time-invariant SNH status, and county-level unemployment rate. Standard errors in parentheses. Standard errors are level. HHI, Herfindahl-Hirschman Index; SNH, safety-net hospital; HMA, hospital market area; RUCA, rural-urban commuting area.

Sensitivity analyses in Table S4 examine the lagged effect of market concentration on profitability, results that are qualitatively the same as the main models. Further results also suggested that the inclusion of the pandemic year 2020 in our main models posed no significant impact on our estimates (see Table S5), and that there seem to be no significant differences in the effects by bed sizes (see Table S6).

In addition, our three specifications were also estimated using two alternative dependent variables proxying for price: inpatient revenue per patient day and inpatient revenue per discharge. While consistent in the direction of coefficients with models using operating margins, inpatient revenue models did not yield statistically significant results (see Tables S7,S8).

Discussion

Key findings

We documented trends in hospital market concentration and operating margins for New Jersey overall and in its eight-hospital markets over the period 2010–2020 and examined the association between these measures. Hospital markets in New Jersey underwent increasing consolidation during our study period and by 2020, six HMAs, accounting for 71% of the total admissions in New Jersey, were considered “highly concentrated” based on FTC and DOJ standards. Several of the markets (e.g., Morristown, Toms River, and Trenton) were already highly concentrated in 2010 and experienced additional consolidation that likely increased hospital market power substantially. Other markets such as Newark/Jersey City, Camden, and New Brunswick that were not highly concentrated in 2010, became so during our study period. These market concentration patterns that we discerned in New Jersey are consistent with trends in other states and at the national level (4,44).

Our regression analyses revealed that hospital market concentration was positively associated with operating margins at higher levels of concentration, specifically when market concentration exceeded a HHI threshold of 0.361 (the quadratic inflection point). However, below this threshold level, we discerned a negative relation between market concentration and operating margins. Notably, this result holds even as we controlled for hospital ownership status, among other characteristics.

While unexpected, we suspect that the negative relationship at low levels of HHI may be due to low margins incentivizing M&A activities, leading to increased market concentration. This nonlinearity is an important contribution to the current evidence on the association between hospital market consolidation and prices (11,45) and could help explain specific instances when a positive relationship is not found. Indeed, cross-sectional research showed that hospitals in the bottom 10% of operating margin ranking were much more likely to merge or become acquired in the US, compared to those at the top 10% (4.0% vs. 0.3%) (46). The nonlinearity is also consistent with evidence that the impact of consolidation can increase disproportionately when in response to merging hospitals, rival hospitals in the same geographic market also raise prices (47). As effect sizes from the lagged models (see Table S2) did not differ meaningfully from our main results, it appears that the potential effect of increased concentration on margins occurred rather immediate. Our paper contributes to the literature by examining the variation in a wide range of competition levels and documenting the non-monotonicity, while the existing literature mostly focused on certain entry or merger events and thus only find a monotonic relationship (48,49).

In 2020, half of the HMAs in New Jersey were highly concentrated, and further consolidation in those HMAs is likely to result in a price increase in those markets. In light of these findings, the several proposed mergers in the state are of particular concern. The positive association that we discern between hospital consolidation and profitability is empirically consistent with some notable changes in the New Jersey hospital landscape over the last decade. For instance, in the Morristown market area, there was a clear upward trend in both HHI and weighted average operating margin. Morristown was consistently the most concentrated HMA in New Jersey, where Atlantic Health System controlled 65.2% of the market share by beds in 2010 and 73% in 2020. There was a 0.10-point jump in HHI between 2015 to 2016 that was primarily due to Atlantic Health System’s acquisition of Hackettstown Medical Center (50) and that year also saw a 16% increase in operating margin.

Implications

Our findings suggest several critical steps for policymakers and antitrust authorities considering multiple consolidation initiatives that are currently underway. First, since most markets are highly concentrated, antitrust enforcement agencies must closely monitor proposed M&As that will further increase market power and reduce competition (51). For this, New Jersey should enhance its capacity for monitoring local hospital markets, either through independent initiatives or in collaboration with federal authorities. In a 2021 study, based on a cross-state comparison, New Jersey was characterized as having only moderate review authority with criteria focusing on transactions that influence access to care and affordability and cost of care (52,53). It is also one out of 10 states that requires transacting entities to provide notice to multiple state agencies that ensure better assessment and evaluation of mergers or acquisitions (52). Ongoing initiatives in states like Massachusetts, Oregon, and New York in merger review, reporting requirements, and post-merger pricing regulation can provide guidance towards enhancing state legal framework to prevent further erosion of competition and resultant price increases in the concentrated hospital markets.

Limitations

Our study had several limitations. First, our results reflected the association of market concentration with hospital operating margins, and do not prove causality. Our regression analysis could not account for possible differences in quality of care or reputation across hospitals that could contribute to differences in demand for services and margins. Second, profitability and pricing were proxied by changing operating margins and measures of inpatient revenue per unit of service, as we did not have access to insurer-paid claims data or hospital-insurer contracts to measure prices directly. Other factors such as hospital cost structures could also affect margins, but we believe pricing is likely to be a major contributor. In terms of our alternative revenue measures, we had no suitable data for combining inpatient and outpatient revenues per unit of service for our estimates and had no way to determine whether the absence of statistical significance in these models was the result of missing data on ambulatory revenue or whether they indicated weak or absent price effects. Finally, our analysis could not account for out-of-state competition resulting from New Jersey patients crossing state borders for hospital care. However, our findings would be biased upward only if growing consolidation in New Jersey was accompanied by decreasing hospital competition from New York, Pennsylvania, or Delaware, which seems unlikely given national trends.

Conclusions

Our study provides in-depth analyses of the association between hospital market concentration and hospital profitability in New Jersey, yielding important new findings to inform local and national policymaking on hospital market structure and competition policy. Our findings strongly underscore the need for scrutiny of proposed M&A activity, rigorous enforcement of antitrust regulations, and development of policies to monitor and regulate prices and quality of care in markets that are already highly concentrated. Future research should examine the extent to which interstate competition impacts hospital pricing and profitability by utilizing patient hospital utilization and financial performance data from bordering states. In addition, using comprehensive hospital pricing information from insurer claims or other sources would allow analysis of direct measures of hospital prices.

Healthcare price increases have been the primary drivers of healthcare spending growth in the U.S. (54). A recent survey (55) indicates bipartisan support for policies addressing high hospital prices, consolidation, and anti-competitive practices. As expected, U.S. hospitals prices are high relative to those of other industrialized countries. According to data from the Commonwealth Fund published in 2016, the U.S. spent $21,063 per hospital discharge in 2014, compared to the OECD median of $10,530. In Germany for instance, the cost per discharge was only $5,900, or 28 percent of the U.S. cost (56). Growing hospital consolidation and the resultant market power apart from increasing prices, has also been shown to diminish the quality of healthcare services when reduced market competition reduces consumer choices among providers (57). The U.S. is an outlier among developed nations in its reliance on negotiations between private insurers and care providers to establish prices and it stands alone in its lack of government regulation of pricing for hospital care (58). In fact, for markets where prices are regulated, research has demonstrated a positive relationship between competition and quality (59). These quality effects are relevant in public payer delivery systems such as Medicaid or Medicare as well as in countries like Australia, Switzerland, or Canada where private providers enter into transactions with public payers (60-62).

Acknowledgments

Funding: This project was supported in part with funds from the Robert Wood Johnson Foundation (Grant No. 79661) and the Summer Research Internship Program of the Rutgers University Institute for Health, Health Care Policy and Aging Research.

Footnote

We used New Jersey Acute Care Hospital (ACH) annual cost reports to which all NJ-licensed ACHs are required to report to the New Jersey Department of Health. Cost data in the ACH report are required by law to reflect results of audited hospital financial reports. The datasets were obtained under a request pursuant to New Jersey’s Open Public Records Act.

New Jersey, though spanning seven metropolitan statistical areas (MSAs), is a densely populated state that is in fact dominated by two large MSAs shared with neighboring states. The other five MSAs each only contain a single NJ county. Hence, MSAs are not useful units for studying state-level hospital market conditions. The 21 New Jersey counties vary widely in population size, characteristics, and market conditions, hence, are also not useful units to study hospital market dynamics.

The RUCA code delineates metropolitan, micropolitan, small town, and rural commuting areas based on the size and direction of the primary (largest) commuting flows for each zip code on a scale of one to ten. New Jersey is highly urban: most hospitals are located in areas with RUCA code of one, with a minority located in areas with a code of two and four. Based on this context, a dummy variable for urban location was created to assign urban status to those with RUCA code of one.

Peer Review File: Available at https://jhmhp.amegroups.com/article/view/10.21037/jhmhp-23-101/prf

Conflicts of Interest: All authors have completed the ICMJE uniform disclosure form (available at https://jhmhp.amegroups.com/article/view/10.21037/jhmhp-23-101/coif). The authors have no conflicts of interest to declare.

Ethical Statement: The authors are accountable for all aspects of the work in ensuring that questions related to the accuracy or integrity of any part of the work are appropriately investigated and resolved. IRB approval and informed consent are waived for this study as no human experiment was involved.

Open Access Statement: This is an Open Access article distributed in accordance with the Creative Commons Attribution-NonCommercial-NoDerivs 4.0 International License (CC BY-NC-ND 4.0), which permits the non-commercial replication and distribution of the article with the strict proviso that no changes or edits are made and the original work is properly cited (including links to both the formal publication through the relevant DOI and the license). See: https://creativecommons.org/licenses/by-nc-nd/4.0/.

References

- Singh A. 2021 M&A in review: a new phase in healthcare partnerships. Kaufman, Hall & Associates. 2022 [cited 2022 Aug 4]. Available online: https://www.kaufmanhall.com/insights/research-report/2021-ma-review-new-phase-healthcare-partnerships

- Singh A. 2022 M&A in review: regaining momentum. Kaufman, Hall & Associates. 2023 [cited 2023 Feb 13]. Available online: https://www.kaufmanhall.com/insights/research-report/2022-ma-review-regaining-momentum

- Beaulieu ND, Dafny LS, Landon BE, et al. Changes in Quality of Care after Hospital Mergers and Acquisitions. N Engl J Med 2020;382:51-9. [Crossref] [PubMed]

- Cooper Z, Gaynor M. Addressing hospital concentration and rising consolidation in the United States. 1% Steps for Health Care Reform. 2021 [cited 2023 Jan 1]. Available online: https://onepercentsteps.com/policy-briefs/addressing-hospital-concentration-and-rising-consolidation-in-the-united-states/

- Gowrisankaran G, Nevo A, Town R. Mergers when prices are negotiated: evidence from the hospital industry. Am Econ Rev 2015;105s:172-203. [Crossref]

- Tenn S. The price effects of hospital mergers: a case study of the sutter–summit transaction. Int J Econ Bus 2011;18:65-82. [Crossref]

- Weiss LW. The structure-conduct-performance paradigm and antitrust. University of Pennsylvania Law Review 1979;127:1104-40. [Crossref]

- Schmitt M. Do hospital mergers reduce costs? Journal of Health Economics 2017;52:74-94. [Crossref] [PubMed]

- American Hospital Association. Trendwatch chartbook 2018 [Internet]. 2018 [cited 2024 Feb 8]. Available online: https://www.aha.org/system/files/2018-07/2018-aha-chartbook.pdf

- Cooper Z, Craig SV, Gaynor M, et al. The price ain't right? Hospital prices and health spending on the privately insured. Q J Econ 2019;134:51-107. [Crossref] [PubMed]

- Gaynor M, Town R. The impact of hospital consolidation. Robert Wood Johnson Foundation; 2012 Jun [cited 2023 Jan 1]. Available online: https://www.rwjf.org/en/library/research/2012/06/the-impact-of-hospital-consolidation.html

- Tsai TC, Jha AK. Hospital consolidation, competition, and quality: is bigger necessarily better? JAMA 2014;312:29-30. [Crossref] [PubMed]

- Town R, Vistnes G. Hospital competition in HMO networks. J Health Econ 2001;20:733-53. [Crossref] [PubMed]

- Lewis MS, Pflum KE. Hospital systems and bargaining power: evidence from out-of-market acquisitions. RAND J Econ 2017;48:579-610. [Crossref]

- Dafny L, Ho K, Lee RS. The price effects of cross-market mergers: theory and evidence from the hospital industry. RAND J Econ 2019;50:286-325. [Crossref]

- Lynk WJ. Nonprofit hospital mergers and the exercise of market power. J Law Econ 1995;38:437-61. [Crossref]

- Melnick G, Keeler E, Zwanziger J. Market power and hospital pricing: are nonprofits different? Health Aff (Millwood) 1999;18:167-73. [Crossref] [PubMed]

- Rabbani M. Non-profit hospital mergers: the effect on healthcare costs and utilization. Int J Health Econ Manag 2021;21:427-55. [Crossref] [PubMed]

- Wang Y, Anderson G. Hospital resource allocation decisions when market prices exceed Medicare prices. Health Serv Res 2022;57:237-47. [Crossref] [PubMed]

- Kessler DP, McClellan MB. Is hospital competition socially wasteful? Q J Econ 2000;115:577-615. [Crossref]

- Schneider H. Incorporating health care quality into health antitrust law. BMC Health Serv Res 2008;8:89. [Crossref] [PubMed]

- Akosa Antwi Y, Gaynor M, Vogt W. A bargain at twice the price? California hospital prices in the new millennium. National Bureau of Economic Research, Inc; 2009 Jul [cited 2023 May 28]. Report No.: 15134. Available online: https://econpapers.repec.org/paper/nbrnberwo/15134.htm

- Dranove D, Lindrooth R, White WD, et al. Is the impact of managed care on hospital prices decreasing? J Health Econ 2008;27:362-76. [Crossref] [PubMed]

- Melnick G, Keeler E. The effects of multi-hospital systems on hospital prices. J Health Econ 2007;26:400-13. [Crossref] [PubMed]

- Moriya AS, Vogt WB, Gaynor M. Hospital prices and market structure in the hospital and insurance industries. Health Econ Policy Law 2010;5:459-79. [Crossref] [PubMed]

- Wu VY. Managed care’s price bargaining with hospitals. J Health Econ 2009;28:350-60. [Crossref] [PubMed]

- Washburn L. Pressure building on NJ’s independent hospitals. 2016 Nov 25 [cited 2023 May 28]. Available online: https://www.northjersey.com/story/news/health/2016/11/25/pressure-building-njs-independent-hospitals/94361904/

- Federal Trade Commission. Federal Trade Commission. 2022 [cited 2023 Jan 2]. Hackensack Meridian Health, Inc. and Englewood Healthcare Foundation, in the matter of. Available online: https://www.ftc.gov/legal-library/browse/cases-proceedings/2010044-hackensack-meridian-health-inc-englewood-healthcare-foundation-matter

- Lagasse J. Coalition of attorneys general move to block New Jersey hospital merger. Healthcare Finance News. 2021 Nov 9 [cited 2023 Feb 13]. Available online: https://www.healthcarefinancenews.com/news/coalition-attorneys-general-move-block-new-jersey-hospital-merger

- Federal Trade Commission. Federal Trade Commission. 2022 [cited 2022 Aug 4]. FTC Sues to block merger between New Jersey Healthcare rivals RWJBarnabas Health and Saint Peter’s Healthcare System. Available online: https://www.ftc.gov/news-events/news/press-releases/2022/06/ftc-sues-block-merger-between-new-jersey-healthcare-rivals-rwjbarnabas-health-saint-peters

- Saint Peter’s Healthcare System. Saint Peter’s Healthcare System. 2024 [cited 2024 Feb 8]. Atlantic Health and Saint Peter’s announce plans to seek partnership. Available online: https://www.saintpetershcs.com/news/2024/atlantic-health-s-and-saint-peter%E2%80%99s-announce-plans-to-seek-partnership

- Cooper University Health Care. Cooper University Health Care and Cape Regional Health System to join forces to expand services to Jersey Shore residents and visitorss. Inside Cooper. 2022 [cited 2023 Feb 13]. Available online: https://blogs.cooperhealth.org/news/2022/12/cooper-university-health-care-and-cape-regional-health-system-to-join-forces-to-expand-services-to-jersey-shore-residents-and-visitors/

- Department of Health, State of New Jersey. Department of Health, State of New Jersey. [cited 2023 Jan 2]. Health department forms. Available online: https://healthapps.state.nj.us/forms/subforms.aspx?pro=hf

- Centers for Medicare & Medicaid Services Data. Hospital Provider Cost Report [Internet]. [cited 2024 Jan 21]. Available online: https://data.cms.gov/provider-compliance/cost-report/hospital-provider-cost-report

- New Jersey Hospital Association. 2020 [cited 2022 Aug 4]. List of NJ providers. Available online: https://www.njha.com/membership/list-of-nj-providers/

- Gaffney LK, Michelson KA. Analysis of Hospital Operating Margins and Provision of Safety Net Services. JAMA Netw Open 2023;6:e238785. [Crossref] [PubMed]

- Hospital Alliance of New Jersey. [cited 2023 Jan 2]. Hospital Alliance of NJ - staff & members. Available online: https://www.hospitalalliance.org/staff

- U.S. Department of Agriculture. Rural-urban commuting area codes. 2023 [cited 2024 Feb 8]. Available online: https://www.ers.usda.gov/data-products/rural-urban-commuting-area-codes/

- Bureau of Labor Statistics. Local Area Unemployment Statistics (LAUS). [cited 2024 Jan 21]. Available online: https://www.bls.gov/data/#unemployment

- New Jersey Commission on rationalizing health care resources final report. New Jersey Commission on Rationalizing Health Care Resources; 2008 Jan [cited 2022 Aug 4]. Available online: https://www.nj.gov/health/rhc/documents/entire_finalreport.pdf

- U.S. Department of Justice and the Federal Trade Commission. 2010 [cited 2022 Aug 4]. Horizontal merger guidelines. Available online: https://www.justice.gov/atr/horizontal-merger-guidelines-08192010

- U.S. Department of Justice. Herfindahl-Hirschman Index. 2015 [cited 2023 Feb 13]. Available online: https://www.justice.gov/atr/herfindahl-hirschman-index

- Awoyemi BO, Olaniyan O. The effects of market concentration on health care price and quality in hospital markets in Ibadan, Nigeria. J Mark Access Health Policy 2021;9:1938895. [Crossref] [PubMed]

- Fulton BD. Health Care Market Concentration Trends In The United States: Evidence And Policy Responses. Health Aff (Millwood) 2017;36:1530-8. [Crossref] [PubMed]

- Gaynor M, Town R. Competition in health care markets. The Centre for Market and Public Organisation, University of Bristol, UK; 2012 Jan [cited 2023 Jan 3]. Available online: https://econpapers.repec.org/paper/bricmpowp/12_2f282.htm

- Ly DP, Jha AK, Epstein AM. The association between hospital margins, quality of care, and closure or other change in operating status. J Gen Intern Med 2011;26:1291-6. [Crossref] [PubMed]

- Dafny L. Estimation and identification of merger effects: an application to hospital mergers. J Law Econ 2009;52:523-50. [Crossref]

- Alpanda S, Zubairy S. Business cycle implications of firm market power in labor and product markets. Rochester, NY; 2021 [cited 2024 Feb 3]. Available online: https://papers.ssrn.com/abstract=3973661

- Kwoka J, Shumilkina E. The price effect of eliminating potential competition: evidence from an airline merger*. J Ind Econ 2010;58:767-93. [Crossref]

- Atlantic Health System. Hackettstown Regional Medical Center officially becomes part of Atlantic Health System. 2016 [cited 2024 Jan 22]. Available online: https://www.atlantichealth.org/about-us/stay-connected/news/press-releases/2016/april16-hackettstown.html

- Brown EC, Gudiksen KL. Models for enhanced health care market oversight — State attorneys general, health departments, and independent oversight entitiess. Milbank Memorial Fund. [cited 2024 Feb 7]. Available online: https://www.milbank.org/publications/models-for-enhanced-health-care-market-oversight-state-attorneys-general-health-departments-and-independent-oversight-entities/

- Montague A, Gudiksen K, King J. State action to oversee consolidation of health care providers. The Milbank Memorial Fund; 2021 [cited 2023 Jan 1]. Available online: https://www.milbank.org/publications/state-action-to-oversee-consolidation-of-health-care-providers/

- The Source on Healthcare Price & Competition. The Source on HealthCare Price and Competition. [cited 2022 Dec 10]. Market Consolidation. Available online: https://sourceonhealthcare.org/market-consolidation/

- Anderson GF, Hussey P, Petrosyan V. It's Still The Prices, Stupid: Why The US Spends So Much On Health Care, And A Tribute To Uwe Reinhardt. Health Aff (Millwood) 2019;38:87-95. [Crossref] [PubMed]

- Arnold Ventures. Arnold Ventures. 2023 [cited 2023 May 28]. New poll: majority of voters support aggressive congressional action to lower hospital prices. Available online: https://www.arnoldventures.org/stories/new-poll-majority-of-voters-support-aggressive-congressional-action-to-lower-hospital-prices

- Sarnak DO. Multinational comparisons of health systems data, 2016. The Commonwealth Fund; 2016 Nov [cited 2023 Jun 10]. Available online: https://www.commonwealthfund.org/publications/other-publication/2016/nov/multinational-comparisons-health-systems-data-2016

- Gaynor M, Moreno-Serra R, Propper C. Death by market power: reform, competition, and patient outcomes in the national health service. Am Econ J Econ Policy 2013;5:134-66. [Crossref]

- International profiles of health care systems. The Commonwealth Fund; 2020 [cited 2023 Aug 10]. Available online: https://www.commonwealthfund.org/sites/default/files/2020-12/International_Profiles_of_Health_Care_Systems_Dec2020.pdf

- Gaynor M. What do we know about competition and quality in health care markets? National Bureau of Economic Research; 2006 [cited 2023 May 28]. (Working Paper Series). Available online: https://www.nber.org/papers/w12301

- Department of Health and Aged Care. Australian Government Department of Health and Aged Care. Australian Government Department of Health and Aged Care; 2023 [cited 2023 Aug 10]. Private health insurance reforms. Available online: https://www.health.gov.au/topics/private-health-insurance/private-health-insurance-reforms

- Lee SK, Rowe BH, Mahl SK. Increased Private Healthcare for Canada: Is That the Right Solution? Healthc Policy 2021;16:30-42. [Crossref] [PubMed]

- Schmid CPR, Beck K, Kauer L. Chapter 16 - health plan payment in Switzerland. In: McGuire TG, van Kleef RC, editors. Risk Adjustment, Risk Sharing and Premium Regulation in Health Insurance Marketss. Academic Press; 2018:453-89. [cited 2023 Aug 10]. Available online: https://www.sciencedirect.com/science/article/pii/B9780128113257000166

Cite this article as: Lu R, Chakravarty S, Wu B, Cantor JC. Recent trends in hospital market concentration and profitability: the case of New Jersey. J Hosp Manag Health Policy 2024;8:1.