Infrastructure recapitalization cost savings from facility operations investments in Washington State hospitals

Highlight box

Key findings

• Hospitals in a state of deferred maintenance spend significantly more on infrastructure recapitalization than do hospitals not in a state of deferred maintenance.

What is known and what is new?

• The replacement of aging hospital infrastructure is critical to maintaining a safe and effective built environment. There is growing concern that without billions of additional dollars being invested in facility infrastructure, the majority of hospitals in North America may exceed their useful life within the next decade.

• This manuscript explores a method to predict financial returns from investments in facility operations to influence the likelihood of approvals related to facility funding.

What is the implication, and what should change now?

• A new linear model can guide healthcare organizations in making fiscal policies related to facility renewal forecasting and in overcoming barriers to securing adequate facility budgets that optimize the safety and performance of the built environment.

Introduction

Maintaining physical assets, including keeping buildings and equipment in satisfactory condition to extend their useful life, is a vital function of facility management (1). Nevertheless, maintaining physical facilities and fixed-equipment activities is at times delayed because of budget constraints and the unavailability of labor and parts (2,3). Deferring maintenance can be a management approach when resources are limited and can have a quantifiable value. According to the Federal Accounting Standards Advisory Board (2), there is no clear standard that organizations should use to calculate the cost of deferred maintenance. However, accounting measurements do typically include one of two primary methods: (I) condition assessments, which involve inspecting assets to determine their current condition and estimating the cost to correct deficiencies, and (II) life-cycle costing, which involves comparing actual and estimated deferred operating expenses to life-cycle forecasts. Deferred maintenance costs are not generally included on an organization’s financial statements but may be provided as supplementary information.

Deferred maintenance is ubiquitous in facility management vocabulary and has a variety of meanings; the lack of one standard meaning creates challenges in addressing the topic (4). This paper considers the meaning of deferred maintenance from a financial perspective, defining the term as operational spending that is insufficient to sustain expected asset lifecycles and that does not include activities aimed at expanding or upgrading the capacity of an asset beyond its original intent. Sustainment is the opposite of deferred maintenance; facility operating expenses are sufficient to maintain expected asset lifespans. Asset renewal, replacement, and recapitalization are terms that describe efforts to extend the life of usable systems and to exchange unusable assets, and these activities are generally paid for with capital budget funds, which can accumulate over time as assets age (2,5-7). This paper uses the term recapitalization for expenses related to infrastructure renewal and replacement of existing facilities and equipment.

Facility sustainment and recapitalization in hospitals are critical to maintaining safe and effective built environments in which to provide community healthcare services, educate future healthcare professionals, and conduct clinical research (8,9). There is growing concern that without billions of additional dollars being invested in facility infrastructure, the majority of hospitals in North America may exceed their useful life by 2031 (10-12). Historically, organizations have struggled to secure sufficient capital funding for major infrastructure renewal projects (13). A contributing factor to this difficulty is a lack of information necessary to develop a sound business case for the projects (14). It is assumed that creating a method to predict financial returns from investments in facility operations will significantly increase the number of approvals related to facility funding (15).

As a means of addressing facility infrastructure recapitalization needs, the American Society for Healthcare Engineering (16) has encouraged its members to increase hospital facility operating expenditures to help prolong fixed-asset lifespans and reduce capital costs. This guidance presents a logical approach because adequate maintenance spending may extend facility systems’ lifespans and reduce the frequency of replacement (17). However, no current research indicates that increased spending, or investing, in facility operations has a clear return on investment (ROI). Numerous researchers have developed models to predict infrastructure recapitalization costs to support the strategic forecasting that is critical to successful organizations (18). These models are primarily based on system age and installation charges (19-23) and facility operating expenses, determined by considering hospital utilization metrics and property values (24,25). A common recommendation for estimating facility costs is to calculate 2–4 percent of a facility’s current replacement value (26); however, this method does not differentiate expense types and has not been widely adopted, partly because of a lack of statistical validation. Prior to this study, researchers had not examined how changes to facility maintenance and repair may affect capital asset spending and other quality outcomes. Therefore, the purpose of this study was to examine whether variations in a hospital’s facility operating expenses are associated with its infrastructure recapitalization costs. The findings can support healthcare organizations’ fiscal policies related to forecasting infrastructure renewal and overcoming barriers to securing facility budgets that are adequate to optimize the safety and performance of the built environment.

Methods

The department of health website for each state was reviewed to identify hospitals’ publicly reported financial statements. To find these statements, the following search terms were used: “financial”, “income”, “balance sheet”, “statement”, and “annual report”. Only hospitals in Washington were included in this study because it was the only state that publicly reported detailed cost account information at the plant level. Financial statements for 2018 and 2019 were evaluated in this study.

Statements from hospitals that experienced changes in gross square feet (GSF) or a decrease in gross plant, property, and equipment values (adjusted using building, building equipment, and lease improvement accounts) were not included in this study, to ensure that fluctuations in facility expenses were not the result of a major facility acquisition or disposition activity. Further, statements from behavioral health hospitals were not included in the study because their admission norms differ from acute-care hospitals. Of the 76 licensed hospitals in Washington, 59 had GSF changes; had decreases in gross plant, property, and equipment values; or were behavioral health hospitals. Therefore, only 17 hospitals were included in this study. Although the sample size was small, it exceeded minimum sample size expectations for statistical reliability with a 95% confidence level and a population proportion with a 10% margin of error (27). The Declaration of Helsinki, participant consent, nor ethical approvals apply to this study as no medical research involving human subjects was conducted.

Statistical analysis

Differences in hospitals’ 2018 and 2019 adjusted plant, property, and equipment values were compared to facility operating expense benchmarks, calculated at $1,217 per admission based on the hospital facility expense ratio model developed by Call et al. (24) for hospitals in Washington during this same timeframe. The goal was to determine the annual infrastructure recapitalization investment. The data were analyzed through using a combination of statistical techniques, including an independent sample t-test, to examine whether statistically significant differences in infrastructure recapitalization spending exist between hospitals in a state of deferred maintenance and hospitals in a state of sustained maintenance. Linear regression was used to determine the relationship between infrastructure recapitalization costs and facility operation spending per admission. Land, land improvements, other fixed equipment, and lease equipment values were not considered to be part of infrastructure recapitalization investments because items charged to these accounts are not replaced or repaired and they are not fixed to the facility (e.g., medical equipment). A wide range of expense types may be included in buildings, building equipment, lease improvements, and construction-in-progress values as determined by generally accepted accounting principles (28).

Results

The average annual number of admissions between 2018 and 2019 at the 17 hospitals analyzed in this study was 10,500, and the average facility operating variance (benchmark minus actual facility operating expense) was $2,100,000 (Table 1). The average hospital area was 597,000 GSF, and the average annual infrastructure recapitalization investment was $2,800,000; the average infrastructure recapitalization investment per GSF was $5.34 (see Tables 1,2).

Table 1

| Hospital | Admissions | Facility operating expense variance (benchmark minus actual) | Facility operating expense variance per admission |

|---|---|---|---|

| A | 325 | $247,788 | $762.42 |

| B | 1,089 | $421,549 | $387.10 |

| C | 1,216 | $152,644 | $125.53 |

| D | 300 | $172,427 | $574.76 |

| E | 204 | $151,854 | $744.38 |

| F | 2,832 | $2,010,628 | $709.97 |

| G | 5,667 | $3,511,441 | $619.63 |

| H | 1,471 | $515,388 | $350.37 |

| I | 5,408 | $1,918,415 | $354.74 |

| J | 19,567 | $2,551,619 | $130.40 |

| K | 22,069 | $16,703,837 | $756.89 |

| L | 8,472 | $4,221,166 | $498.25 |

| M | 9,520 | $2,922,520 | $306.99 |

| N | 8,505 | $2,974,467 | $349.73 |

| O | 32,112 | $18,304,398 | $570.02 |

| P | 16,073 | $9,532,452 | $593.07 |

| Q | 42,721 | $15,099,377 | $353.44 |

Table 2

| Hospital | Gross square feet | Annual infrastructure recapitalization investment | Annual infrastructure recapitalization investment per gross square foot |

|---|---|---|---|

| A | 34,195 | $0 | $0.00 |

| B | 54,302 | $309,419 | $5.69 |

| C | 71,735 | $0 | $0.00 |

| D | 77,714 | $368,419 | $4.74 |

| E | 88,741 | $1,789,895 | $20.17 |

| F | 114,201 | $66,854 | $0.59 |

| G | 155,374 | $462,847 | $2.98 |

| H | 190,169 | $0 | $0.00 |

| I | 433,631 | $0 | $0.00 |

| J | 456,937 | $2,638,971 | $5.78 |

| K | 662,040 | $21,726,273 | $32.82 |

| L | 677,159 | $0 | $0.00 |

| M | 745,880 | $354,145 | $0.47 |

| N | 809,833 | $1,352,360 | $1.67 |

| O | 849,730 | $7,261,484 | $8.55 |

| P | 1,522,811 | $11,056,437 | $7.26 |

| Q | 3,200,145 | $411,780 | $0.13 |

When facility operating expenses were below benchmarks, hospitals in a state of deferred maintenance spent significantly more money on recapitalization than did hospitals in a state of sustained maintenance when facility operating expenses were at or above benchmarks (Table 3); just over half of the hospitals were in a state of sustained maintenance. There was a statistically significant difference in the average infrastructure recapitalization investment per GSF of hospitals grouped by those in a state of sustained maintenance and hospitals in a state of deferred maintenance, t(13)=−2.178, P<0.05. Two hospitals with infrastructure recapitalization investments greater than 5 times their group average (Hospital K at $32.82 and Hospital P at $7.26) were considered outliers and were therefore removed from this analysis.

Table 3

| Facility maintenance status | Infrastructure recapitalization expenses per gross square foot |

|---|---|

| Sustained | $0.86 |

| Deferred | $6.27 |

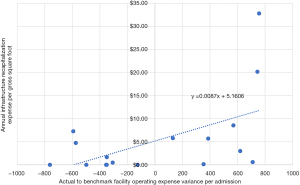

A hospital’s infrastructure recapitalization costs can be reliably predicted by examining the hospital’s facility operating expenses in relation to the benchmark. Linear regression was completed to understand the effect of facility operating expenses on infrastructure recapitalization investment. To assess linearity, the researchers created a scatterplot of recapitalization investment per GSF in relation to facility operating expense variance (actual to benchmark) per admission (Figure 1). Visual inspection of the scatterplot indicates that there is a linear relationship between these variables.

The prediction equation was as follows: annual infrastructure recapitalization investment per GSF =0.0087 × facility operating expense variance per admission + 5.16, calculating the actual-to-benchmark variance of facility operating expenses per admission was verified to be a statistically significant method of predicting infrastructure recapitalization investment per GSF, F(1,15)=5.573, P<0.05. The actual-to-benchmark variance accounted for 20% of the variance in infrastructure recapitalization investment per GSF, with adjusted R2=22%, a medium size effect according to Cohen (29).

Discussion

The results of this research are useful in developing a business case to justify adequate facility budgets. As many hospitals continue to face increasing financial pressures from decreased margins (30), developing and communicating a sound business case is imperative to secure necessary funding amidst competing projects (31). The findings from this study provide a benchmark for levels of infrastructure recapitalization investment and reinforce the logic that adequate maintenance activities and spending can support facility systems’ lifespans (32). Because of the statistically significant correlation between facility operating expenses per admission and recapitalization investment, a linear model can be used to predict financial returns from capital savings as a result of increases to facility operating budgets. A similar model has been used by building owners and facility practitioners for decades in predicting capital construction costs savings from association to market factors and indexes (33,34).

The following example is presented to demonstrate how this model can be used to predict the financial returns from increasing facility operating budgets: Hospital XYZ has 5,000 admissions per year and an area of 650,000 GSF. The hospital spends $4,000,000 annually on facility operations, and the benchmark is $6,085,000 (=5,000×1,217). Therefore, Hospital XYZ has a facility operating variance per admission of $417 [(=6,085,000−4,000,000)/5,000]. Using the linear model to predict annual infrastructure recapitalization investment per GSF (=0.0087 × facility operating expense variance per admission + 5.16), the annual infrastructure recapitalization investment is predicted to be $8.79 per GSF [(=0.0087×417)+5.16]. If Hospital XYZ increased facility operating expenses by $2,085,000 to no longer operate in a state of deferred maintenance, the predicted infrastructure recapitalization investment would change to $5.16 per GSF, a savings of $3.63 per GSF (=8.79−5.16), equating to $2,360,000 (=3.63×650,000) and an ROI of 13 percent [(=2,360,000–2,085,000)/2,085,000]. Although the linear model may not always produce a positive ROI in terms of predicted capital savings, the model is still helpful in benchmarking the capital replacement funds needed for sustaining and replacing aging infrastructure to promote a reliable environment of care (35). As Washington is the only state to publicly report hospital utilization and financial statements along with facility operating expenses, the ratio model developed for this research may be unreliable beyond the Northwest region of the United States. In addition to this geographic limitation, this model does not account for time value of money and may be unreliable beyond acute-care hospital properties.

Conclusions

Hospitals in a state of deferred maintenance invest significantly more money in infrastructure recapitalization than do hospitals in a state of sustained maintenance. There is a statistically significant correlation between hospitals’ facility operating expenses per admission and infrastructure recapitalization costs. A linear model was created to benchmark expected levels of hospital infrastructure recapitalization investment and to predict financial returns from investments in facility operations. This model can guide healthcare organizations in making fiscal policies related to forecasting facility infrastructure costs and in overcoming barriers to securing adequate facility budgets that optimize the safety and performance of the built environment. Future research should examine the connections between hospital facility expenses and patient and clinical outcomes. To address ongoing facility infrastructure challenges, it may be beneficial to develop and test models to predict facility cost savings for other property types in a variety of locations.

Acknowledgments

Funding: None.

Footnote

Peer Review File: Available at https://jhmhp.amegroups.com/article/view/10.21037/jhmhp-22-128/prf

Conflicts of Interest: The author has completed the ICMJE uniform disclosure form (available at https://jhmhp.amegroups.com/article/view/10.21037/jhmhp-22-128/coif). The author has no conflicts of interest to declare.

Ethical Statement: The author is accountable for all aspects of the work in ensuring that questions related to the accuracy or integrity of any part of the work are appropriately investigated and resolved. The Declaration of Helsinki, participant consent, nor ethical approvals apply to this study as no medical research involving human subjects was conducted.

Open Access Statement: This is an Open Access article distributed in accordance with the Creative Commons Attribution-NonCommercial-NoDerivs 4.0 International License (CC BY-NC-ND 4.0), which permits the non-commercial replication and distribution of the article with the strict proviso that no changes or edits are made and the original work is properly cited (including links to both the formal publication through the relevant DOI and the license). See: https://creativecommons.org/licenses/by-nc-nd/4.0/.

References

- Lewis B, Payant R. Facility manager’s maintenance handbook. McGraw-Hill; 2007.

- Federal Accounting Standards Advisory Board. Amendments to deferred maintenance reporting. 1999. Available online: http://files.fasab.gov/pdffiles/sras14.pdf

- IFMA. Maintenance. Available online: https://reliabilityweb.com/tips/article/the_definition_of_maintenance_reliability

- Yasin MN, Mohamad Zin R, Hamid MY, et al. Deferred maintenance of buildings: a review paper. IOP Conf Ser: Mater Sci Eng 2019;513:012028.

- Kaiser H. Capital renewal and deferred maintenance. Association of Higher Education Facilities Officers. 2015.

- U.S. House of Representatives. Readiness and sustainment of the navy’s surface fleet: hearing before the Readiness Subcommittee of the Committee on Armed Services. U.S. Government Printing Office. 2009.

- National Research Council. Recapitalizing the navy: A strategy for managing the infrastructure. National Academies Press; 1998.

- U.S. House of Representatives. Deferred maintenance in VA hospitals: hearing before the Subcommittee on Hospitals Committee on Veterans’ Affairs. U.S. Government Printing Office. 1959.

- WHO. Hospitals. Available online: https://www.who.int/health-topics/hospitals#tab=tab_1

- AHA. AHA fact sheet. 2021. Available online: https://www.aha.org/fact-sheets/2021-05-26-fact-sheet-ensuring-hospital-infrastructure-meets-nations-needs-today-and

- Morgan J. Dealing with deferred maintenance. Health Facilities Management 2021. Available online: https://www.hfmmagazine.com/articles/4282-dealing-with-deferred-maintenance

- Cloutier P. Canada’s leaders must prioritize crumbing health infrastructure. HealthcareCAN 2020. Available online: https://www.healthcarecan.ca/2020/09/22/canadas-leaders-must-prioritize-crumbling-health-infrastructure/

- Kim J, Ebdon C. Asset maintenance practices and challenges in U.S. counties. Public Works Management & Policy 2021;26:259-78.

- National Research Council. Deferred maintenance reporting for federal facilities: meeting the requirements of federal accounting standards advisory board standard number 6, as amended. National Academies Press; 2001.

- Hatry HP, Liner EB. Issues in deferred maintenance. Urban Institute. 1994.

- American Society for Healthcare Engineering. Infrastructure investment—understanding operational vs. capital investment and the impact on deferred maintenance. 2022. Available online: https://www.ashe.org/education/infrastructure-investment-understanding-operational-vs-capital-investment-and-impact-deferred

- Chalifoux A, Baird J. Reliability centered maintenance (RCM) guide: operating a more effective maintenance program. U.S. Army Corps of Engineers, Construction Engineering Research Laboratories. 1999.

- Shim JK, Siegel JG, Liew CJ. Strategic business forecasting: the complete guide to forecasting real-world company performance. Probus 1994;

- Applied Management Engineering. Managing the facilities portfolio: a practical approach to institutional facility renewal and deferred maintenance. National Association of College and University Business Officers. 1991.

- Biedenweg R, Cummings A. Before the roof caves in, part II: A predictive model for physical plant renewal. Association of Higher Education Facilities Officers. 1997.

- Janke J. Presentation on the Department of Defense Facilities Sustainment Model by Jay Janke, Office of the Secretary of Defense (Installations) before the Federal Facilities Council Standing Committee on Operations and Maintenance. National Research Council. 2000.

- Phillips C Jr. Facilities renewal: the formula approach. Association of Physical Plant Administrators 1986.

- Syme PT, Oschrin J. How to inspect your facilities and still have money left to repair them. Association of Higher Education Facilities Officers. 1996.

- Call S, Smithwick J, Sullivan K. A ratio model for benchmarking and forecasting hospitals’ facility operating expenses in Washington state: Plant, property, and equipment as a key metric. Journal of Facility Management Education and Research 2021;5:22-7.

- National Research Council. Stewardship of federal facilities: a proactive strategy for managing the nation’s public assets. National Academies Press; 1998.

- National Research Council. Budgeting for facilities maintenance and repair activities: report number 131. National Academies Press; 1996.

- Innocenti F, Tan FES, Candel MJJM, et al. Sample size calculation and optimal design for regression-based norming of tests and questionnaires. Psychol Methods 2023;28:89-106. [Crossref] [PubMed]

- PricewaterhouseCoopers. Property, plant, equipment and other assets. 2022. Available online: https://viewpoint.pwc.com/dt/us/en/pwc/accounting_guides/property_plant_equip/assets/pwcppeandotherassets1121.pdf

- Cohen J. Statistical power analysis for the behavioral sciences. 2nd edition. Erlbaum; 1988.

- Ly DP, Cutler DM. Factors of U.S. Hospitals Associated with Improved Profit Margins: An Observational Study. J Gen Intern Med 2018;33:1020-7. [Crossref] [PubMed]

- Garrido T, Raymond B, Jamieson L, et al. Making the business case for hospital information systems—a Kaiser Permanente investment decision. J Health Care Finance 2004;31:16-25.

- Grussing MN, Liu LY. Knowledge-Based Optimization of Building Maintenance, Repair, and Renovation Activities to Improve Facility Life Cycle Investments. Journal of Performance of Constructed Facilities 2014;28:539-48.

- Hwang S. Dynamic regression models for prediction of construction costs. Journal of Construction Engineering and Management 2009;135:360-7.

- Lowe DJ, Emsley MW, Harding A. Predicting construction cost using multiple regression techniques. Journal of Construction Engineering and Management 2006;132:750-8.

- Brown RE, Willis HL. The economics of aging infrastructure. IEEE Power and Energy Magazine 2006;4:36-43.

Cite this article as: Call S. Infrastructure recapitalization cost savings from facility operations investments in Washington State hospitals. J Hosp Manag Health Policy 2023;7:5.